Bank of America: This Chart Shows ‘Deteriorating Liquidity’ Is at the Heart of Market Carnage

Ever since the Federal Reserve began to withdraw monetary stimulus, liquidity has steadily been drying up.

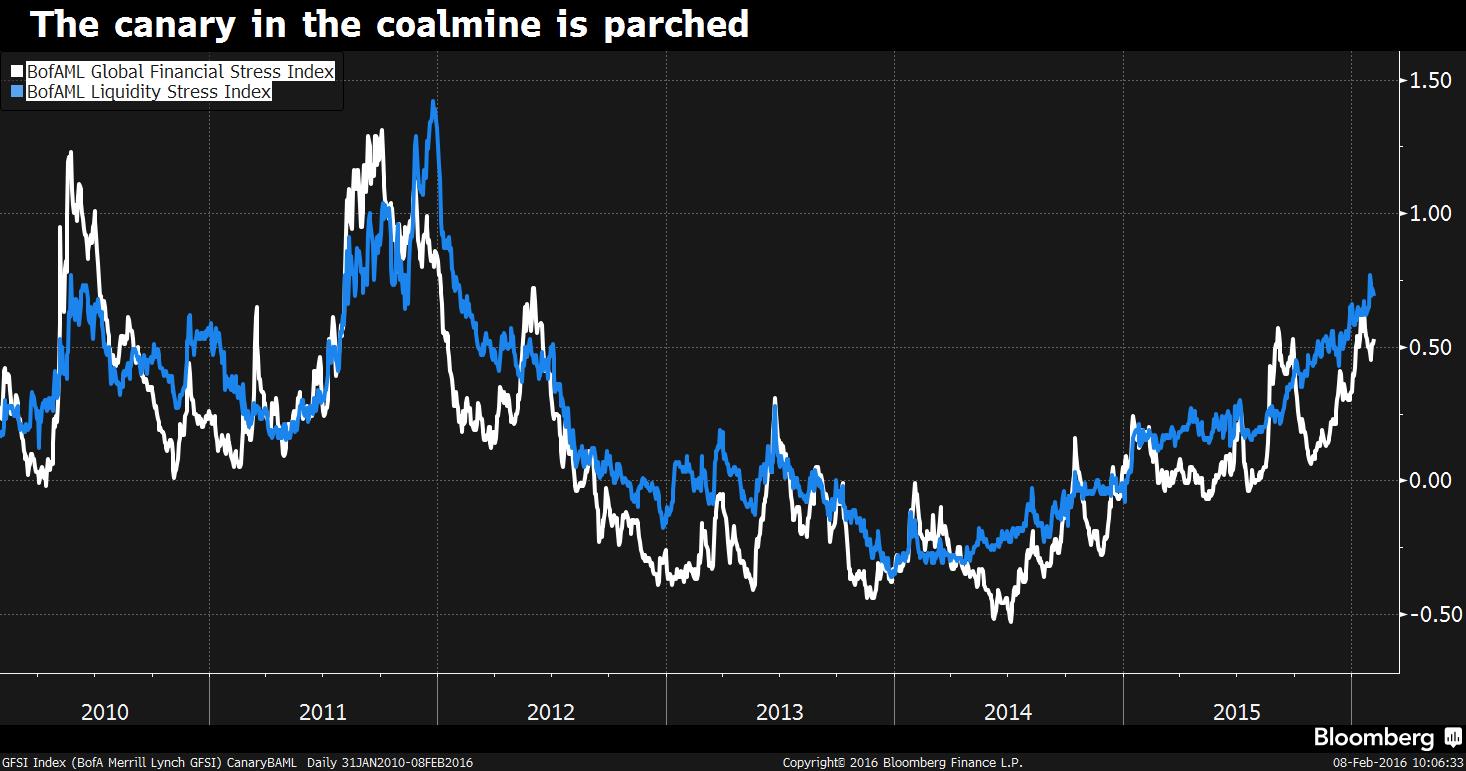

Head of U.S. Mortgages Chris Flanagan and Strategist Mao Ding don’t necessarily lay blame for market dislocations squarely on U.S. monetary policymakers. The two observe, however, that since early 2014—when the Fed began winding down its open-ended asset purchases—liquidity stress has “persistently risen” and served as the proximate cause of the episodic spikes in Merrill Lynch’s Global Financial Stress Index that have since occurred.

The index is a composite measure of market-based indicators of risk, demand for hedging, and risk appetite, while the liquidity subindex tracks a variety of funding spreads, such as Libor-OIS.

“Compared to the broader GFSI, liquidity stress has somewhat methodically and steadily risen over the past two years: while the GFSI has moved higher in fits and starts, liquidity stress has more persistently risen, only pausing its rise at times, before moving higher,” the strategists explained. “This persistence suggests to us that deteriorating liquidity is at the heart of and may be the primary driver of broader rising financial stress.”

Merrill Lynch chalks up the seemingly structural, unrelenting increase in liquidity stress to two factors:

- (1) New regulatory and capital requirements enacted since the financial crisis that restrict trading activity and limit the amount of balance sheet that banks are willing to dedicate to providing liquidity;

- (2) Building off the above, the collapse in commodity prices has sparked severe selloffs in the emerging markets and high-yield debt and led banks to jettison the provision of liquidity to challenged sectors in particular.

“The combination of these two factors has led to a somewhat vicious cycle and feedback loop, where poor liquidity is spreading, and liquidity problems appear to be turning into fundamental problems,” the pair wrote. “Moreover, tightening of monetary policy by the Fed, first through tapering and now through tightening, may have been necessary from an economic perspective, but the tightening appears to be adding fuel to the fire of liquidity deterioration.”

The shift of liquidity risk from the banks to the buy side was a direct byproduct of reforms and regulations designed to strengthen the financial system. If you want banks that are better capitalized and, therefore, more resilient, there’s a trade-off.

In this case, the resilience of liquidity is what appears to have diminished.

“In a world of significantly higher capital requirements for dealers, nobody should really be surprised that balance sheet is scarce and liquidity is lower,” wrote Flanagan and Ding.

Regular readers of Matt Levine’s newsletter or anything on the subject of liquidity will find that these complaints—particularly regarding the regulatory environment—have been raised ad nauseam.

The harder question, which the analysts attempt to answer, is how these current market dynamics can be fixed or improved. With little appetite to redesign regulations, the strategists think that credit is the lone channel through which liquidity can be bolstered. A “coordinated global policy response” at the upcoming G20 meeting in Shanghai (that is, a modern-day Plaza Accord) or a curtailment of oil supply from OPEC and Russia are the two methods by which the most acute instances of credit weakness could be alleviated and the liquidity backdrop buoyed, according to Merrill Lynch.

If liquidity pressures have indeed been the proverbial canary in the coal mine for broader market stress, the rockiness that has prevailed in 2016 may continue to churn rather than calm. Flanagan and Ding warned that widening spreads for a variety of securitized products would accompany an environment in which liquidity continues to be wanting. Risk assets would presumably also come under pressure.

“Barring developments on these fronts, further liquidity deterioration seems inevitable,” they conclude.

Leave a Comment